Model Regresi Pengaruh Rasio Keuangan Terhadap Persentase Pendapatan Bersih Pada Perusahaan Ace Hardware Indonesia Tbk.

DOI:

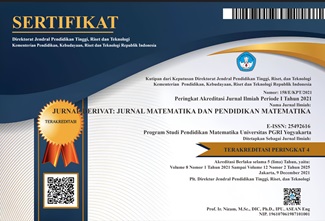

https://doi.org/10.31316/j.derivat.v5i1.146Abstract

This paper describes a mathematical model of finance ratios against net income percentage in Indonesia Hardware Ace Company. This model constructed using multiple linear regression. In this paper, we used some financial ratios such as Current Ratio (CR), ROA, ROE, GPM, OPM, NPM, Payout Ratio, and Yield as ingredients to construct regression mathematics model. We use data from the Indonesia Hardware Ace company report in the year 2013 and 2014. This data available and can download any digital sources especially from Indonesia Capital Market Directory (ICMD). Data then processed using statistical software namely SPSS version 17.0 for helped us constructed a mathematical regression model. This research yields multiple regression model with value of . It means that the mathematical model very completed and useful to the application.

Â

Keyword:Â Finance Ratios, Net Income, Regression, ACE Hardware IndonesiaDownloads

Published

Issue

Section

Citation Check

License

Authors who publish with this journal agree to the following terms:

-

Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution-ShareAlike 4.0 International License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See The Effect of Open Access).