Analisis Nilai Risiko Portofolio Optimum Pada Reksadana Campuran Dengan Pendekatan EWMA

DOI:

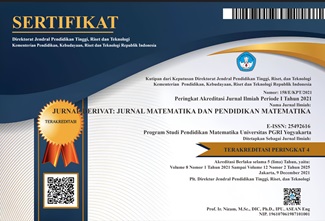

https://doi.org/10.31316/j.derivat.v4i1.159Abstract

Value at Risk (VaR) is one of the risk measurement techniques and is considered a standard method of measuring risk. EWMA is one method to find standard deviation value of Conditional Variance which used to calculate the VaR. Investors use VaR to determine the risk level. VaR defined as the estimated loss of portfolio with a certain level of confidence. A portfolio composed of several mixed mutual funds. Of the four mutual funds only two mutual funds that can be arranged to get an optimum portfolio, 20% of mutual funds Kresna Flexima and 80% Nikko BUMN Plus. Portfolio VaR is calculated by EWMA method because it found the existence of conditional Variance. With a 95% level of trust and decay factor in accordance with the proposed risk metrics of 0.94 for daily data than obtained the VaR value of 0.26221011. This means that the maximum losses that may be received by investors amounted to 26.22% if investors invest in assets recommended by the optimal portfolio. This level of risk will be used by investors to control investment risk.

Â

Keyword: VaR, EWMA, Portofolio Optimum, Reksadana

Downloads

Published

Issue

Section

Citation Check

License

Authors who publish with this journal agree to the following terms:

-

Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution-ShareAlike 4.0 International License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See The Effect of Open Access).