Pengaruh Jangka Pendek Dan Jangka Panjang Variabel Makro Ekonomi Terhadap Ihsg Di Bursa Efek Indonesia Dengan Pendekatan Error Correction Model (ECM)

DOI:

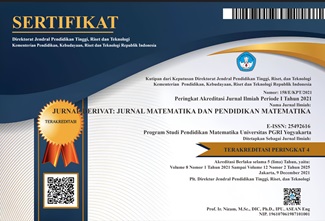

https://doi.org/10.31316/j.derivat.v6i1.332Abstract

Abstract

This study aims to empirically examine the effect of short-term and long-term Inflation, Amount of Current Money, Exchange Rate, Interest Rate of Bank Indonesia, World Oil Price (WTI) and Net Exports on the Composite Stock Price Index (IHSG) using the Error Correction Model method ( ECM) which is processed with reviews 6.0. During the observation period of 2000-2012, there was a relationship between macro variables and the movement of the JCI on the Indonesia Stock Exchange (IDX). The ECM test results show that inflation, exchange rates, and world oil prices have a significant effect on the JCI in the short term while the long-term variables that significantly affect the JCI are CPI, exchange rates, net exports, and world oil prices.

Keywords: CSPI, CPI, JUB, Exchange Rate, Bank Indonesia Interest Rate (rSBI), World Oil Price (WTI), Net Export and Error Correction Model (ECM)Downloads

Published

Issue

Section

Citation Check

License

Authors who publish with this journal agree to the following terms:

-

Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution-ShareAlike 4.0 International License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See The Effect of Open Access).