Peramalan Harga Saham PT. Bank Central Asia, Tbk dengan Menggunakan Metode ARIMA

DOI:

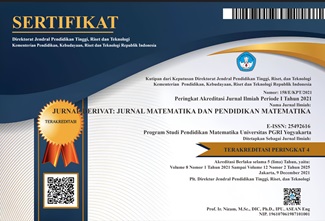

https://doi.org/10.31316/jderivat.v11i1.5329Abstract

The purpose of this research is to analyze the fluctuations and quantity of daily stock closing data of PT. Bank Central Asia Tbk (BCA) during the period from January 3, 2022, to December 30, 2022, and forecast the closing stock price in January 2023 using the ARIMA model. The research procedure was conducted step by step, including data collection, descriptive analysis, testing data stationarity, determining ARIMA model parameters, writing ARIMA equation models, conducting diagnostic tests on the best ARIMA model, and making predictions or forecasts. The analysis shows that the stock closing prices in 2022 fluctuated with an average range of Rp 7,214.29 - Rp 8,851.14 per share. The highest closing price occurred in November 2022, while the lowest occurred in July 2022. The forecast for the daily closing stock price of BCA from January 2 to January 31, 2023, using the ARIMA Model (1,1,0), ranges from Rp 8,550.00 to Rp 8,550.86. The MAPE value obtained from the forecasting result is 1.07%, indicating that the ARIMA model is highly effective in forecasting the closing stock price of BCA in January 2023. This research provides valuable insights into stock price fluctuations for stakeholders in the stock market.

Keywords: fluctuations, ARIMA, stock closing prices, forecast.

References

La Gubu merupakan corresponding author dari artikel ini

Downloads

Published

Issue

Section

Citation Check

License

Copyright (c) 2024 La Gubu, Muhammad Alfian, La Pimpi

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.

Authors who publish with this journal agree to the following terms:

-

Authors retain copyright and grant the journal right of first publication with the work simultaneously licensed under a Creative Commons Attribution-ShareAlike 4.0 International License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this journal.

- Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial publication in this journal.

- Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See The Effect of Open Access).